The Supreme Court of New South Wales issued a judgement in Application of MLC Investments Limited [2022] NSWSC 1541 which is relevant to the issue of whether superannuation trustees are at risk of committing offences under the Crimes Act 1900 (NSW) where it receives benefits in the course of changing trustee or giving effect to a successor fund transfer.

Read MoreThe Financial Accountability Regime and Compensation Scheme of Last Resort Bills have stalled in the Senate, while the faith-based product exceptions to the MySuper annual performance assessment have also been rolled into the broader review of the Your Future, Your Super reforms.

Read MoreThe Commonwealth Budget was the second for 2022, and thankfully, the second quiet budget for superannuation trustees.

Read MoreSuperannuation fund trustees involved in merger or successor fund transfer (SFT) discussions can breathe a little easier after a recent decision poured cool water on concerns that certain merger related dealings may have exposed parties to the risk of criminal prosecution.

Read MoreOn 27 September 2022 ASIC released Regulatory Guide 277 Consumer Remediation (RG 277) which is intended to supersede the existing guidance in Regulatory Guide 256 Client review and remediation conducted by advice licensees (RG 256). RG 277 is a significant expansion of ASIC’s remediation guidance and now applies to all Australian Financial Services (AFS) and Australian Credit licensees, including superannuation trustees.

It is important to note the guidance within RG 277 applies to all remediation activity from 27 September 2022; however licensees may still utilise RG 256 for any remediation programs already underway at this date.

Read MoreIt was a busy month with the re-introduction of FAR and Compensation Scheme of Last Resort legislation to Parliament after lapsing with the calling of the election earlier this year. New measures relating to downsizer contributions were also introduced, along with the faith-based performance test.

Read MoreThe risks of greenwashing are becoming increasingly prevalent and appropriate management of these risks requires input, commitment and training across all areas of a trustee’s operations.

An understanding of how sustainability and responsible investing has been incorporated into the trustee’s investment decision making is a basic requirement for all staff to ensure any representation made is clear and accurate. Penalties for non-compliance are considerable and even a sniff of greenwashing brings about significant media scrutiny and associated costs to the trustee, both financial and reputational.

Read MoreAugust was a month filled with updates from the regulators and treasury, which included: The Quality of Advice Review Proposals Paper; APRA Climate Risk Survey Results; ASIC announcement regarding breach (reportable situation) reporting; and much more.

Read MoreAfter a few quieter months post-election, July brought about the resumption of Parliament and the introduction of our first superannuation-related bill for the year. Treasury has been busy with the announcement of a review into the YFYS reforms, consultation on faith-based superannuation product performance tests and Annual Member Meeting changes.

Read MoreThe focus on delivering member outcomes continues to evolve with the release of Discussion paper – Strategic planning and member outcomes: Proposed enhancements by APRA. Consultation is sought on a range of proposed changes to the current Prudential Standard SPS 515 Strategic Planning and Member Outcomes and associated guidance to incorporate the significant suite of reforms that have impacted the industry since SPS 515 was introduced in 2020.

Read MoreCPS 230 – Operational Risk Management . APRA’s strategic initiative to modernise the prudential architecture. APRA has identified specific questions for feedback that will assist it in finalising the requirements. The standard will commence from 1 January 2024. APRA intends to finalise the standard and release draft guidance for consultation in early 2023, and finalise the guidance in the first half of 2023.

Read MoreThe Superannuation Industry (Supervision) Amendment (Your Future, Your Super— Improving Accountability and Member Outcomes) Regulations 2021 prescribe information that must be given to superannuation fund members either directly or referenced within an annual member meeting notice.

Read MoreSuperannuation trustees are increasingly focused on providing members with tools, information, and advice that are intended to assist members in making decisions and planning for their retirement. Online calculators and retirement estimates play an important role in enabling members to access clearer information about how decisions and scenarios earlier in life will affect their retirement income outcomes.

Read MoreWith the start of the new financial year, we see a myriad of superannuation-related changes come into effect as of 1 July 2022. To finish the 2022 financial year, ASIC issued a new legislative instrument covering superannuation calculators and retirement estimates and information sheet on greenwashing, while APRA confirmed it will be releasing a refreshed investment governance prudential standard.

Read MoreSUPERANNUATION LAW CASE NOTE : Shimshon v MLC Nominees [2021] VSCA 363. QMV LEGAL

Read MoreAfter a long wait following Treasury's initial proposal paper issued in January 2020, the Financial Accountability Regime (FAR) draft legislation has arrived, and there are a few key items that require consideration by superannuation trustees.

Read MoreThe best interests duty is in many ways the cornerstone to the regulation of the superannuation system and has been the most important guiding principle for Australia’s superannuation industry.

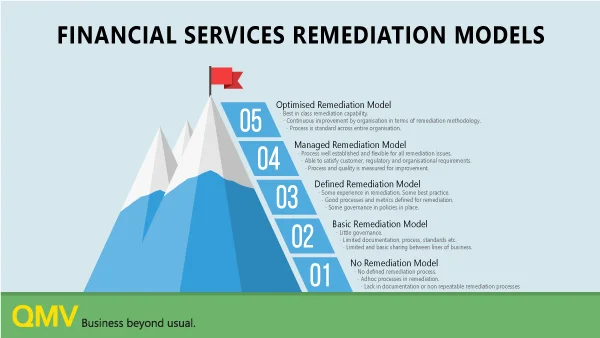

Read MoreThe ability to identify, scope and remediate customer account errors has become a key regulatory item in financial services. These issues can result in breaches and are thus “non-negotiable” with regulators.

Depending on the scale of remediation events, personnel and funding tends to swell and subside. The deeper you look, the more people involved, the more money you throw at it, the more errors you will find.

Read MoreOn 17 February 2021, the Government introduced and read a first time Treasury Laws Amendment (Your Future, Your Super) Bill 2021 (Bill). The Bill was then referred to the Senate Economics Legislation Committee with a report due on 22 April 2021.

Read MoreThe Financial Sector Reform (Hayne Royal Commission Response) Bill 2020 introduced into Parliament departs significantly from the draft legislation as it relates to advice fees in superannuation – this is likely the reason for the delayed introduction and separation from the Hayne Royal Commission Response Bill.

Read More