Data remediation activities in financial services will never cease. The best that can be achieved is significantly reducing the frequency and scope of remediations over time. Remediation does not always indicate a negative financial impact to a customer, but it does indicate a negative financial impact to the organisation.

Read MoreLegislative and regulatory reform has had and will continue to have a significant impact on the superannuation industry. Fund Trustees are faced with the challenge of developing and implementing cost-effective solutions to meet their obligations, often within a condensed timeframe. Therefore, we have outlined six steps in this article that will provide you with the structure and help with successful implementation.

Read MoreOn 27 September 2022 ASIC released Regulatory Guide 277 Consumer Remediation (RG 277) which is intended to supersede the existing guidance in Regulatory Guide 256 Client review and remediation conducted by advice licensees (RG 256). RG 277 is a significant expansion of ASIC’s remediation guidance and now applies to all Australian Financial Services (AFS) and Australian Credit licensees, including superannuation trustees.

It is important to note the guidance within RG 277 applies to all remediation activity from 27 September 2022; however licensees may still utilise RG 256 for any remediation programs already underway at this date.

Read MoreThe quality of data is imperative to strategic decision making, agility, productivity, and survival and qrganisations are beginning to realise that the consequences and risks of making incorrect decisions is now far greater and getting to the point where data is accurate and reliable to derive a "correct” single view of the customer will take commitment, effort, and investment from the financial institutions.

Read MoreTwo weeks ago I spent a day in a shed with people from ART (Australian Retirement Trust was formed by the merger of QSuper and Sunsuper), on a campaign for supporting the local members of the fund. ART visit the island to provide personal information to the local members about their superannuation entitlements and answering their questions about all things retirement.

Read MoreRedesigning a fund’s operating model often involves introducing new systems, migrating from or switching off legacy systems, adding new resources and/or reskilling staff. Funds with established operating models view this change as an unnecessary expense. Shedding this myopic view of the way funds operate is key to the best outcomes for the Trustee and its members.

Read MoreThe key measure of success for any Trustee expense is how it can be expressed in terms of benefits to members. Providing members with more opportunity for higher returns, lower fees and better service are the most common high-level justifications. This can be much trickier for funds considering a merge or SFT.

Read MoreOngoing merger and business transformation activity in superannuation is driving a staggering rate of change and has giving rise to the most interesting transition work QMV has ever faced.

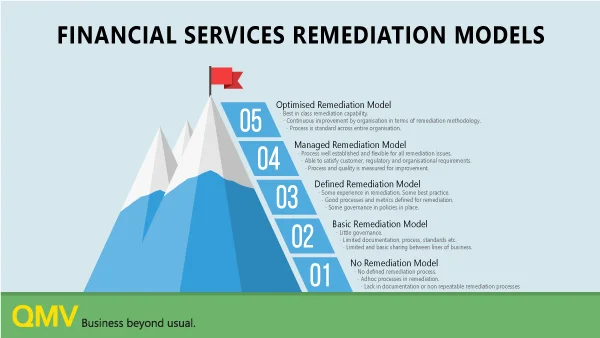

Read MoreThe ability to identify, scope and remediate customer account errors has become a key regulatory item in financial services. These issues can result in breaches and are thus “non-negotiable” with regulators.

Depending on the scale of remediation events, personnel and funding tends to swell and subside. The deeper you look, the more people involved, the more money you throw at it, the more errors you will find.

Read MoreOn 17 February 2021, the Government introduced and read a first time Treasury Laws Amendment (Your Future, Your Super) Bill 2021 (Bill). The Bill was then referred to the Senate Economics Legislation Committee with a report due on 22 April 2021.

Read MoreTrustees need to ‘start their engines’ now to make sure they will be compliant with the design and distribution obligations that will come into effect on 6 April 2021. A project plan needs to be developed now that incorporates product and product governance audits. And that’s before the real work begins!

Read MoreMany data remediation programs are only started after an issue being brought to light by a customer or group of customers: often upon investigation, this gives rise to a slew of other issues that may have been impacting thousands of customers across several years.

Read MoreThe risks of managing other people's money have been laid bare over the course of the ongoing Royal Commission into Misconduct in the Banking, Superannuation and Financial Services. Taking a closer look at the internal control environment is a sensible place to start rebuilding trust.

Read MoreThe Australian Financial Complaints Authority will replace the Superannuation Complaints Tribunal; the Financial Ombudsman Service (FOS); and the Credit and Investments Ombudsman (CIO), no later than 1 November 2018.

Read More