Often, large scale data activities like generating annual statements requires data being transferred between systems and external providers. This can leave superannuation administrators exposed if they are experiencing data quality issues leading to loss of reputation and increased rectification costs.

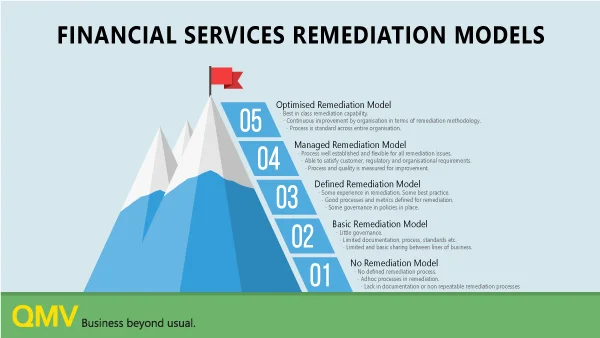

Read MoreMost organisations don’t plan for remediation, their approach is often disjointed, reactive and inefficient. As leaders in remediation, we understand the importance of accuracy, timeliness and communication. At QMV, we believe specialised remediation experts with developed processes, calculation models and the right technology can fast-track remediation work, deliver quality outcomes and reduce costs.

Read MoreA high-performance mentality that promotes collaboration and information exchange is fundamental to realising a fund’s key objectives like developing tailored strategies and products, better meeting member expectations and various uplifts across automations, data quality, emerging technologies and compliance.

Read MoreThe ability to identify, scope and remediate customer account errors has become a key regulatory item in financial services. These issues can result in breaches and are thus “non-negotiable” with regulators.

Depending on the scale of remediation events, personnel and funding tends to swell and subside. The deeper you look, the more people involved, the more money you throw at it, the more errors you will find.

Read MoreThe Hayne Royal Commission raised a question mark over the quality of customer data held by financial institutions and emphasised that action after the fact via costly data remediation events was not good enough. In a post royal commission world, it is important to know why customer data is so prone to error.

Read MoreWe've put together a brief summary of the measures in the Commonwealth Budget directly affecting superannuation trustees. While there is very little detail on some measures at this stage - it is enough to start thinking & planning!

Read MoreIn the last decade, the arrival and development of the ‘cloud’ has had a profound impact on the financial services sector, both in Australia and globally. I’m not talking about the cloud Grampa Simpson is yelling at but referring to the term ‘cloud computing’.

Read MoreContact centres are a hot topic across financial services as institutions look to dominate the customer experience race. The drivers come as a result of higher customer expectations, competitive advantage and the need to rebuild trust post royal commission.

Read MoreThe digital age of customer information opens vast opportunities for financial institutions from providing tailored solutions, omnichannel experience and innovative avenues to communicate with customers.

Read MoreData remediation activities in financial services will never cease. The best that can be achieved is significantly reducing the frequency and scope of remediations over time. This paper is a brief discussion of the triggers, execution and controls associated with data remediation events and can be applied to superannuation, wealth management, banking and insurance.

Read MoreMany data remediation programs are only started after an issue being brought to light by a customer or group of customers: often upon investigation, this gives rise to a slew of other issues that may have been impacting thousands of customers across several years.

Read MoreThe risks of managing other people's money have been laid bare over the course of the ongoing Royal Commission into Misconduct in the Banking, Superannuation and Financial Services. Taking a closer look at the internal control environment is a sensible place to start rebuilding trust.

Read MoreQMV has moved into new Sydney offices situated on Clarence Street. Our permanent base in Sydney is fast approaching twelve months and we sincerely thank QMV's valued clients and friends for their backing.

Read MoreData recently released by APRA provides a high-level picture of the trends in operational expenditure by most large superannuation funds in Australia.

QMV’s analysis of the data shows that since 2004, with the growing scale of assets within the superannuation system means…

Read MoreMany super funds are investing heavily in data profiling and predictive analytics solutions which promise to unlock a tidal wave of insights, often geared toward improving “member engagement”. Indeed, the term “actionable insights” has been dropped countless times across the latest financial services conferences.

But mostly, these analytics solutions are just providing more data — not insights – and it is no wonder.

Read MoreThe Australian Financial Complaints Authority will replace the Superannuation Complaints Tribunal; the Financial Ombudsman Service (FOS); and the Credit and Investments Ombudsman (CIO), no later than 1 November 2018.

Read More